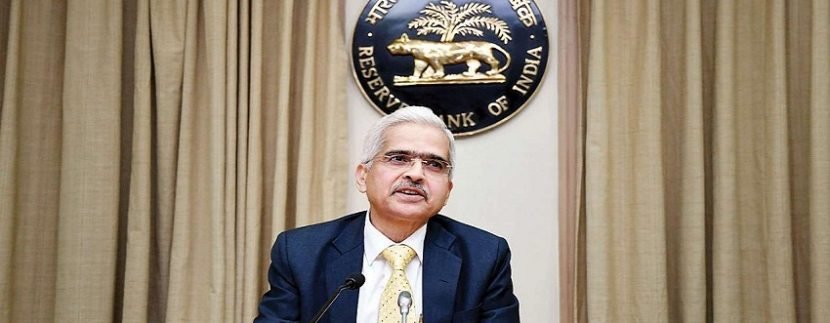

The RBI’s Cut in the Repo Rate by 25 basis points

The RBI’s cut in the repo rate by 25 basis points will cheer the housing sector. Growth in the sector will accelerate, especially as it comes on the back of GST rationalisation

The RBI resorted to a second consecutive policy rate (repo rate) cut by 0.25 percentage points, to 6%, signalling lending institutions like banks and non-banking finance companies to cut their lending rates.

If banks and financial institutions take the cue and cut their lending rates by half a percentage point, it would be a shot in the arm for the economy.

A senior banker said the central bank is worried about a slowdown in the economy, which is clear from the fact that the RBI went for a second consecutive cut in policy rates, inside of two months. This is to ensure that the cut in policy rates is transmitted down the line by banks and NBFCs in their lending rates, he said.

The RBI last cut the rate on February 7, 2019. In the first policy review in 2019-20, the RBI also lowered GDP growth forecast for 2019-20 to 7.2%, down from 7.4% predicted in the February policy.

Apart from the cut in repo rate — the rate at which the RBI lends short-term funds to banks — the RBI also relaxed norms for liquidity coverage to infuse further liquidity in the banking system.

HDFC, while commenting on the central bank’s latest credit policy to increase liquidity in the system, said that the RBI has permitted banks to use an additional 2% of government securities as facility, to avail liquidity for liquidity coverage ratio (FALLCR) so as to meet their liquidity coverage ratio (LCR) requirements.

“This is likely to ease up liquidity pressure in the banking system and, consequently, provide some push to credit growth,’’ a report by HDFC said.

Anshuman Magazine, chairman and CEO (India, South East Asia, Middle East and Africa) of CBRE, says: “The rate cut of 25 bps by the Monetary Policy Committee indicates the intent of the government to keep spurring consumption and boost growth. The move will impact consumer sentiments positively, especially in the real estate sector. Banks may pass on the benefits of the revised rates to end customers, thereby positively impacting their purchase decisions.”

Gagan Banga, VC and MD of Indiabulls Housing Finance Limited, said: “The RBI’s announcement of lowering the repo rate by 25 bps will cheer the housing sector, both on the supply and the demand side. The pick-up in the sector will accelerate, especially as it comes on the back of GST rationalization.’’ Banga said the committee’s proposal to develop housing finance securitization markets, will lead to better management of asset-liability and liquidity in the sector.

“The decision by the RBI to reduce the repo rate by 25 basis points, to 6%, is a hugely positive sign for the Indian real estate industry. The rate cut is expected to substantially enhance homebuyer sentiments and add further impetus to the industry’s revival, which needed a boost, especially after the NBFC crisis,’’ said Satish Magar, president of Credai National. Magar took charge on March 31.

Magar said the EMI burden on homebuyers will also reduce and improve the purchasing power, which is expected to provide a huge stimulus to Indian realty. This step by the RBI can be largely seen as a huge win for homebuyers amidst the government’s constant measures of establishing a highly conducive environment for Indian realty, Magar said.

Niranjan Hiranandani, national president of Naredco, said: “The Indian economy needs liquidity as fuel to power the growth engine. The RBI decision is expected to lift industry sentiments, provide relief to various stakeholders like corporates, as also in real estate and homebuyers. We expect that banks further pass down the benefit for the rate cut to homebuyers, which will further trigger the home-buying into actual sales.”

Source TOI